GIZ BUILDS SMES’ FINANCIAL CAPACITY IN TAKORADI, WESTERN REGION

GIZ BUILDS SMES’ FINANCIAL CAPACITY IN TAKORADI, WESTERN REGION

The Embassy of Ghana wishes to inform the public that GIZ Ghana through its Reform and Investment Partnership Project, the Migration and Employment Promotion component and Financial System Development component under the Programme for Sustainable Economic Development, and Special Initiative for training and job creation (SI jobs) program, held a two-day forum from 30th June to 1st July, 2021 in Takoradi, Western Region.

The forum dubbed “Access to Finance” was targeted at Micro, Small and Medium sized Enterprises (SMEs) in the region to provide insights on how to effectively access financial support for the growth of their enterprises as well as bridge the gap in understanding between financial institutions such as banks and insurance companies, and business owners.

The “Access to Finance” forum provided business owners and entrepreneurs the opportunity to discuss and find solutions to the challenges of accessing finances for their businesses.

Various experts in the field of entrepreneurship and business financing including the Head – CDC Consult, Ernest Senyo Dzandu, Senior Project Manager – Piron Global Development, Ebenezer Asumang, and Director of Projects – Social Entrepreneurship Hub, James Arthur-Amoah expounded on various pertinent issues touching on business development and digitalization as well as fund-raising for SMEs.

This years’ forum in Takoradi included a pitching competition, which saw several SMEs pitch their businesses for the chance to win various prizes like laptops and mobile phones, contributing towards improving the digitalisation of their businesses.

Various financial institutions were present including Access Bank, Fidelity Bank, Allianz insurance and Glico insurance. Participants of the forum also had the opportunity to register for a MoMo merchant sim with MTN, allowing them to transact business using mobile money.

An entrepreneur, Isaac, reiterated the impact of the event, “I am particularly grateful for the rich feedback and encouragement given by the judges during my pitch. I commend GIZ and Duapa Werkspace (local innovation hub) for the immense work they are putting into transforming local businesses to become competent players both locally and on the global front”.

Since 2020, the forum organised in the Ashanti and Bono regions has reached over 200 business owners with pertinent information on accessing finance for their businesses and improved their ability to generate capital through various funding strategies.

EMBASSY OF GHANA

BERLIN

09th July, 2021

PROCEDURES ON OBTAINING TAX IDENTIFICATION NUMBER (TIN) ABROAD

PUBLIC NOTICE

PROCEDURES ON OBTAINING

TAX IDENTIFICATION NUMBER (TIN) ABROAD

Following representations by some Ghanaian citizens abroad on the difficulty in acquiring their tax identification numbers (hereinafter named TIN), the Ministry wishes to furnish below the necessary steps

required for access to a TIN under the taxpayers identification numbering system Act 2002, (ACT632):

(a) Applicants should visit the Ghana Revenue Authority (GRA) website at gra.gov.gh;

(b) Download the TIN form to complete and sign it;

(c) Scan the completed form together with a clear copy of one of the following ID cards;

• A valid passport

• Driver´s license

• Ghana voter card

• National identification card

(d) Forward the completed TIN form and scanned ID card to the GRA´s contact person:

Nana Mensah Otoo (Esq.)

(Principal Legal Officer in Charge of

Treaties and International Agreements)

Via email address: nana.otoo@gra.gov.gh

(e) Upon receipt of the completed documents, the GRA will revert with the relevant TIN number to the applicant.

2. For companies, applicants will need documents such as:

* Certificate of incorporation

* Commencement of Business certificate

* Partnership certificate

* External company letter

3. Acquisition of a Tin is free of charge. It is a prerequisite for the discharge of one´s tax obligations, particularly for every person liable to pay tax, or required to withhold tax at source (see Section 4 of the TIN system Act 2002, (Act 632).

4. For the avoidance of doubt, under section 8 of Act 632, without a TIN one shall not be permitted to do the following:

“(i) To clear any goods in commercial quantities from any ports or factory;

(ii) To register any title to land, interest in Land or any document affecting land;

(iii) To obtain any tax clearance certificate from the Internal Revenue Service, Customs Excise and Preventive Service or the Value Added Tax Service;

(iv) To obtain a certificate to commence business or a business permit issued by the Registrar-General or a District Assembly;

(v) To receive payment from the Controller and Accountant-General or a District Assembly in respect of a contract for the supply of any goods or provision of services unless that person quotes the TIN issued in respect of that person under the system.”

5. Besides, a TIN is required for the registration of vehicles and acquisition of passports and driver´s license.

EMBASSY OF GHANA

BERLIN

28th April, 2021

BANK OF GHANA DIRECTIVES ON THE GHANA INVESTMENT PROMOTION CENTRE (GIPC) TECHNOLOGY TRANSIFER AGREEMENT (TTA)

The Embassy of Ghana in Berlin wishes to share some information on the Bank of Ghana Directives on the Ghana Investment Promotion Centre (GIPC) Technology Transfer Agreement (TTA).

As part of measures to check illicit financial flows, the Bank of Ghana (BoG) has directed all commercial banks in the country to demand the Ghana Investment Promotion Centre (GIPC) Technology Transfer Agreement (TTA) from all multinational companies operating in the country before funds are transferred outside.

These directives are not only to ensure strict adherence to money transfer guidelines and check illegal capital flight but also to engender compliance of the GIPC’s TTA. The Central Bank has indicated that funds that were transferred under TTAs and were not registered will attract sanctions when evidence of such transactions becomes available.

Per information from the Banking Supervision Department of Bank of Ghana, various countries where the transfers end up will be contacted to double-check every paper-trail that is associated with all the monies transferred.

Technology Transfer Agreement (TTA)

Under the GIPC’s legislation, a TTA refers to an agreement between a company in Ghana (Transferee) and a company outside Ghana, related or non-related (Transferor), for a duration of an initial 18 months to 10 years and renewable for 18 months to five years.

The agreement involves assignment, sale and licencing of all forms of industrial property such as patents, industrial designs, trademarks or the provision of technical expertise by a foreign company to a locally-based company.

It also involves the provision of managerial services and know-how: such as information, data whether patentable or not – including technical or commercial information relating to research, design, development manufacture, use or sale and personnel training.

EMBASSY OF GHANA BERLIN

2nd July, 2021

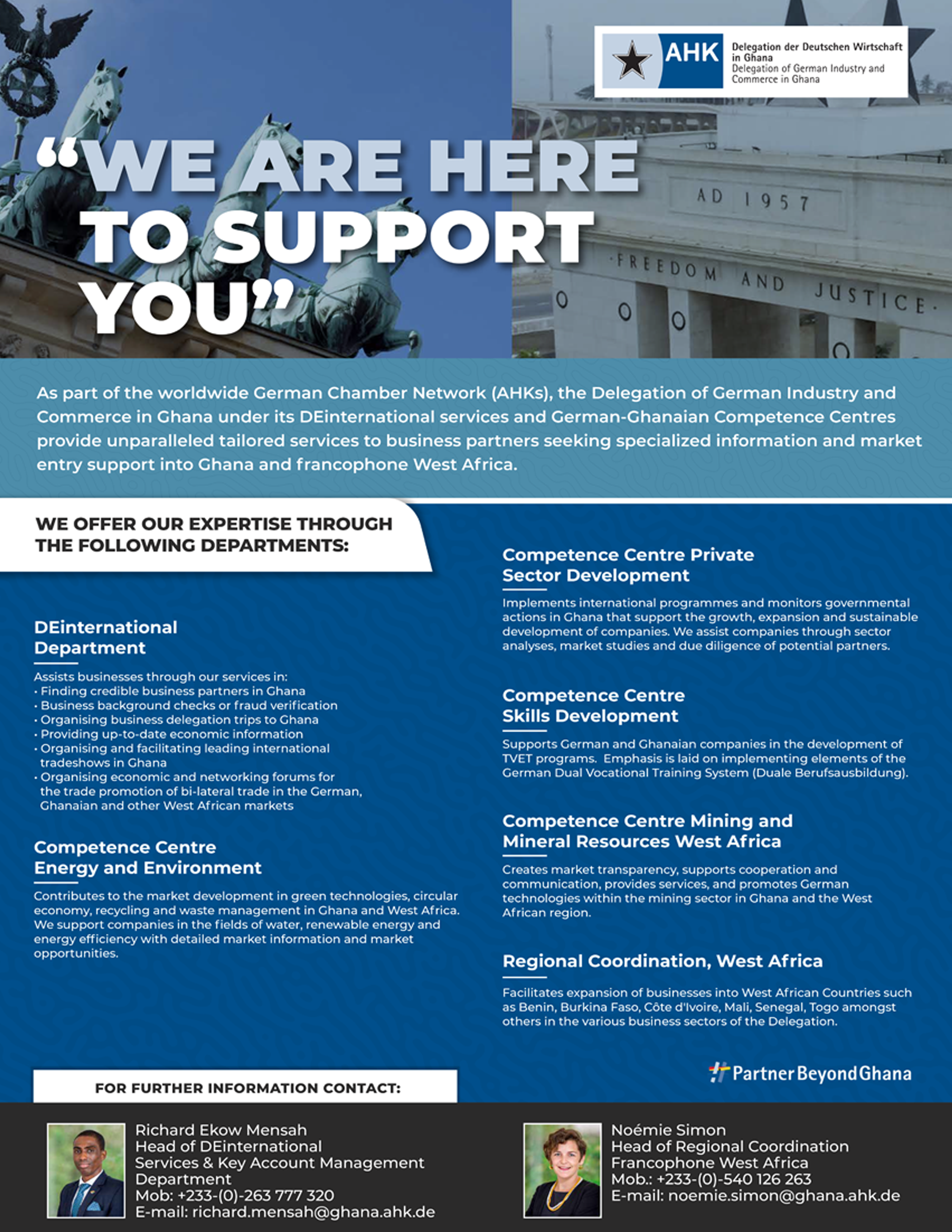

THE DELEGATION OF GERMAN INDUSTRY AND COMMERCE IN GHANA-MEMBER OF THE AHK NETWORK

The Embassy of Ghana in Berlin wishes to share some information on the Delegation of German Industry and Commerce in Ghana (AHK-Ghana). At 140 locations in 92 countries around the world, the German Chamber Network (AHKs) offers its experience, network and services to German and foreign companies. AHKs are located in all countries which are of special interest for German industry and business. The Delegation of German Industry and Commerce in Ghana is part of the worldwide AHK German Chamber Network. As a Delegation, it is the preliminary stage for a bilateral Chamber of Commerce.

AHK Ghana therefore aims to sustainably enhance the economic activities between Germany, Ghana and other West African countries (Mali, Benin, Ivory Coast, Togo, Senegal, Burkina Faso).

Drawing from its vast experience and expertise, they are able to provide high quality services to German, Ghanaian and other West African companies seeking a comprehensive overview of the various markets of interest in order to make well-informed business decisions. AHK-Ghana offers a vast range of services through the DEinternational Department and its Competence Centre for Energy & Environment.

The Delegation is closely connected to the Chambers of Industry and Commerce (IHKs) in Germany. Together, they support German companies with promoting and extending their business relations to foreign countries. The umbrella organisation of the IHKs is the German Association of Chambers of Industry and Commerce (DIHK), which also coordinates and supports the AHKs and Delegations. Furthermore, the cooperation with various German trade associations strengthens the link between AHKs and business markets.

Are you interested in exploring business opportunities in Ghana? Do you wish to invest in the second most peaceful country in Africa (according to the 2021 Global Peace Index)? If your answers are in the affirmative, kindly find other salient information and contact details of AHK-Ghana in the digital flyer below.

Amb. Gina Blay recently paid a courtesy call on Mr. Burkhardt Hellemann, Head of Delegation of AHK in Accra, Ghana.

From left: Mr. Richard Ekow Mensah, Head of DEinternational Services & Key Account Management, AHK, Amb. Gina Ama Blay, Hon. Freddie Blay, Chairman of the NPP and Mr. Burkhardt Hellemann, Head of Delegation, AHK

EMBASSY OF GHANA BERLIN

29TH June, 2021

A GUIDE TO DOING BUSINESS IN GHANA

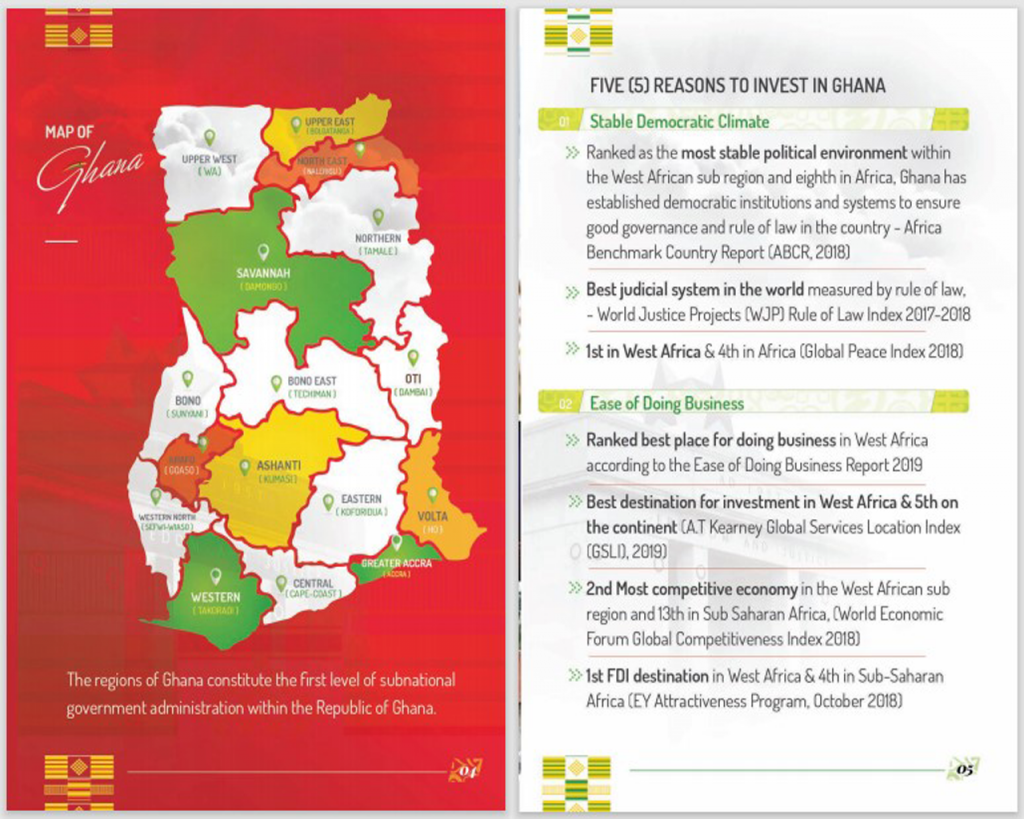

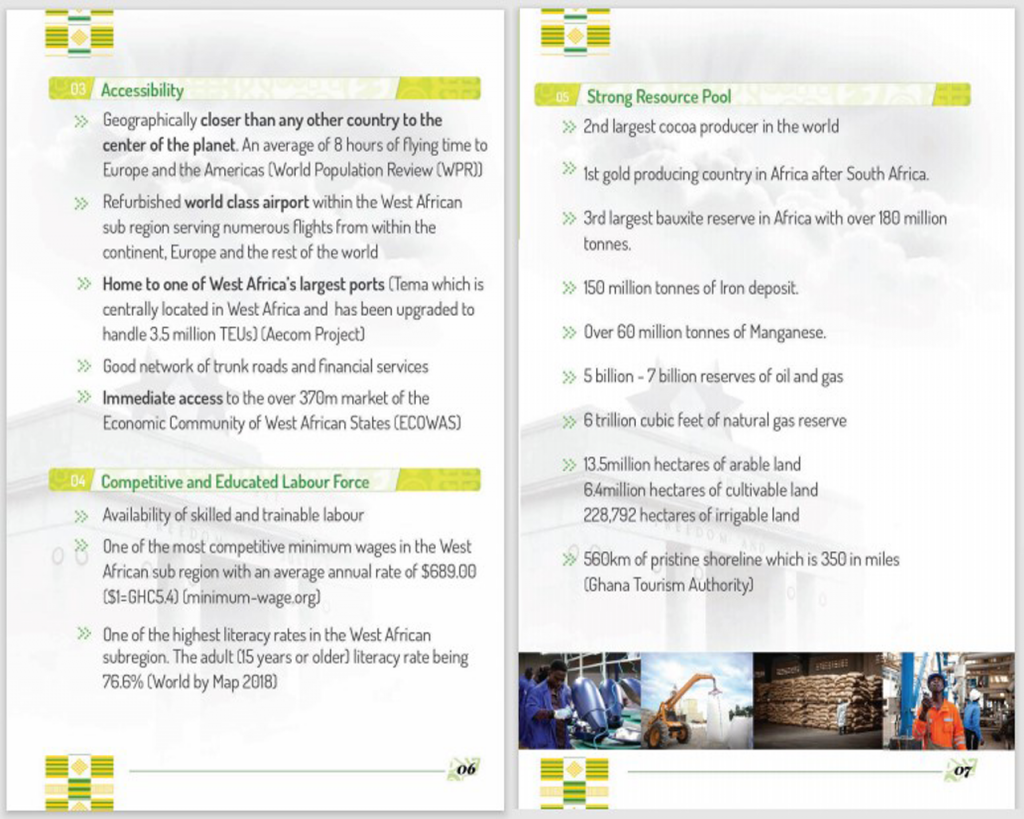

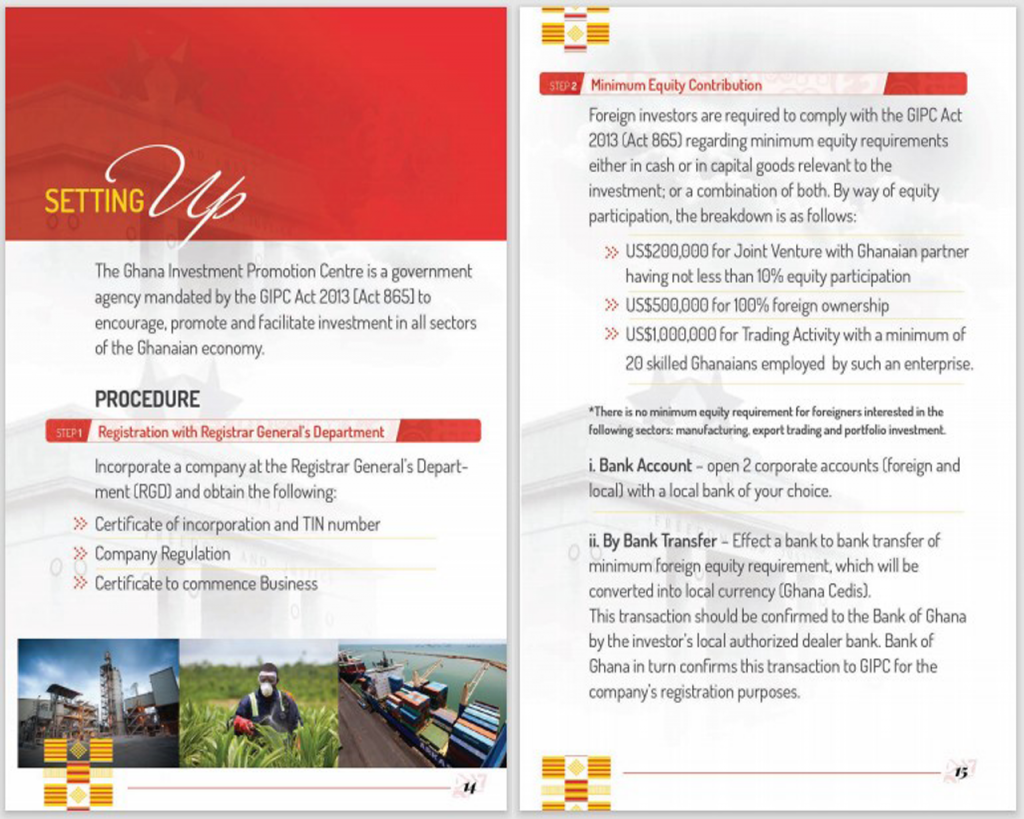

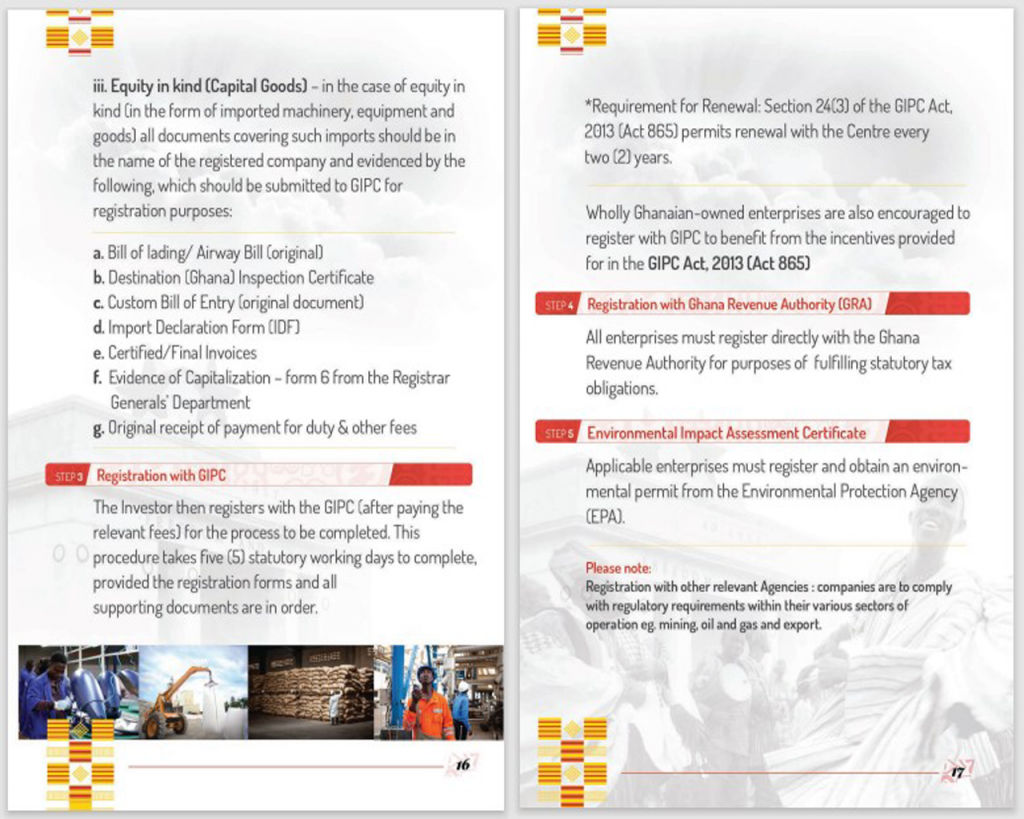

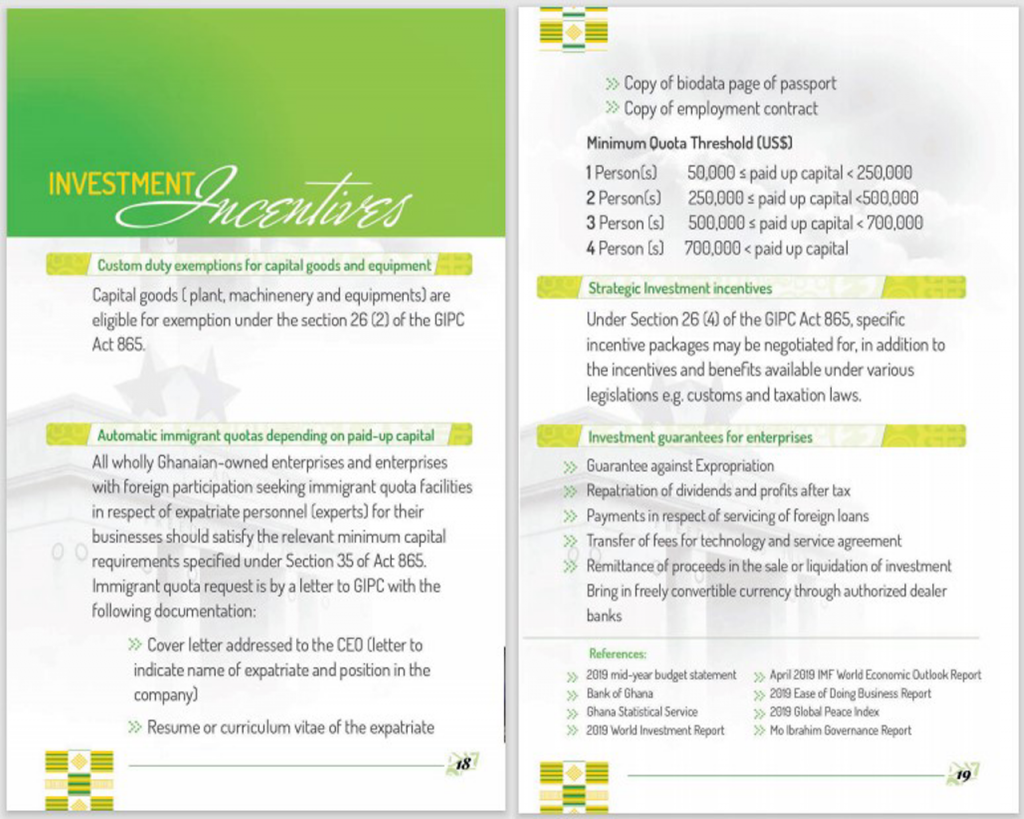

The Embassy of Ghana wishes to share an e-brochure captioned‚ “Your Passport to Invest in Ghana”. The e-brochure was designed by the Ghana Investment Promotion Centre (GIPC), Ghana’s foremost investment attraction and promotion agency.

The digital publication provides salient and basic information on Ghana in general, procedure for setting up a business as well as investment opportunities and incentives.

Kindly access the document via the link below:

EMBASSY OF GHANA

BERLIN

7 April, 2021

Our Address

Embassy of Ghana, Germany

Chancery Section

Stavangerstrasse 17 and 19

10439 Berlin, Germany

P: (+49) 30 54 71 49-0

F: (+49) 30 44 67 40 63

E-Mail:

Please Click Here for Email with Subject

Embassy of Ghana, Germany

Consular Section

Stavangerstrasse 17 and 19

10439 Berlin, Germany

P: (+49) 30 54 71 49-50

F: (+49) 30 44 67 40 63

E-Mail:

Please Click Here for Email with Subject